Description

Buy Movocash Accounts

Article background information [to use as knowledge, not to be copied verbatim]: This could be the perfect place for the one seeking to buy move cash accounts through on the web. don’t be hesitate to buy bulk move cash accounts from us to gain multiple purposes. Buy Movocash Account now.

How do You get access?

Yes, you have a unique link given by us. You need to give this link to your customers or friends, when they buy from it you will get 50% of the profit generated from their purchase.

What is the minimum amount required for me as an individual to invest in move cash?

There are no restrictions on that but normally we suggest 2k (200$) because it’s good enough for making profits in long term. There are no restrictions on the minimum investment amount and number of accounts. If you have a desire then go ahead with any account size I think you will get the maximum profit to compare to small accounts.

I am operating as a private trader without any office space. So I want somewhere online/offline place, I can buy these accounts for cheap.

You can easily buy these accounts online from our official site, there is no need of going anywhere else for buying it and also there are no restrictions on the number of accounts you can buy anybody can buy as many accounts they want but we suggest 2k (200$) which is good enough to start trading in any market.

What is a MOVO account?

When you open a new account at Orange Everyday Bank, you will be eligible to receive interest in the form of MOVO credits. These MOVO credits can help offset monthly fees or other service charges. Here’s an example:

What You Get and What it Means to You On your first deposit of any amount, you’ll get 100 MOVO Credits on the account within 30 days. That is equal to $1 in interest for every $200 in your savings, checking and money market accounts combined (or $5 per month). If you continue the cycle with additional deposits, those amounts are also credited at 100 MOVO Credits ($1 in interest) for each $200 – up to a maximum of 200 MOVO Credits ($2 in interest) per month depending on how much you deposit. For example, if you make additional deposits of $1,000 to your savings account and $500 to a checking or money market account in any one calendar month plus the amount of your initial deposit into Orange every day ($200), then you will receive up to 200 MOVO Credits ($5).

When you open an Orange Everyday Account, a minimum deposit of $5 is required. Deposits made during the first 30 days qualify toward earning credits. By depositing more than the minimum each day as part of your routine transactions (deposit and withdrawal) for six months, you can earn up to 500 MOVO Credits over that half-year period (which are equal to $12.50 in interest).

When you open an Orange Everyday Account, you’ll also be eligible to earn MOVO Rewards Points on qualifying purchases and services. You can redeem your MOVO Credits for rewards such as A $25 cash reward A $25 credit on DIRECTV®, or up to 50% off the cost of a new activation (up to $75) *To get more details about these rewards and the other terms and conditions associated with earning and using MOVO credits, please speak with a representative at any branch. In addition, every Orange County customer is able to enroll in the My Good Life program when opening their account online or through our call center. The My Good Life program gives customers access to discounts at participating merchants including restaurants, entertainment venues, retail stores, and more.

The Orange Everyday Account is a checking account designed for the Orange County customer who wants to earn interest and rewards on their everyday banking activities (deposits, withdrawals, debit card purchases) with no monthly service fees or minimum balance requirements. Unlike traditional checking accounts that charge fees each month regardless of how much money you have in your account, the Orange Everyday Account offers savings-like benefits at an everyday price. Here you can Movocash Accounts to buy. We offer Buy Movocash Accounts. Don’t waste your time looking for Buy Movocash Accounts. Buy verified Movocash Accounts right now.

Movo Cash Powered Greendot Bank

We offer real accounts with valid information.

- You can create unlimited virtual cards from your account panel.

- For a small fee, top up your Movo Cash account with bitcoin.

- You can send and receive the money within the USA.

- You will be able to open a U.S. bank account and have VCC options.

- A mobile app is all you need to access your account and create VCC.

- Accept direct deposit and pay with Samsung Pay, Apple Pay, etc.

Delivery Materials

- Personal information of the user

- Login ID and Password

- Access to the phone number

- Requirements and Liability

- To avoid any suspension, you should use a US IP address.

- Pre-activated account For moment initiation, you will need to top up at least $25

- Movo Accounts:

Movocash Accounts

Movo is not your father’s pre-paid card. The card is not available online or in shops. It speaks cryptocurrency. Movo customers may not send cards by any means. This is by design. Movo’s item is more like an “e-wallet app” rather than a pre-paid card.

You can call it whatever you like. Movo remains firmly in the prepaid debit category, despite its virtual card and bitcoin exchange features. However, this doesn’t mean that some won’t enjoy the more innovative features. The majority of prepaid cards still offer the basic features. They can also be very affordable.

Movo Prepaid Visa Card is not the right product for you? You might also be interested in other prepaid debit cards options on our Best Prepaid Cards List.

Movo: How Does It Work?

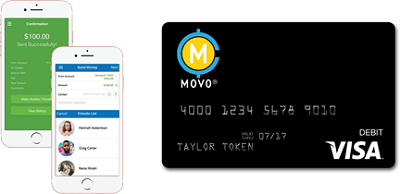

It’s all about the Movo Cash App. You can’t obtain a Movo card via its website, unlike most prepaid cards. Instead, you can download the free cash app and create a Movo account using the app. You don’t need to be certain that your account will be used by a physical card, unlike other prepaid cards. You can spend funds immediately after you open a Movo account.

Digital Wallets And Virtual Cards

Movo app demonstrating digital cards. To make purchases at physical retailers, your Movo account can be connected to one of three huge digital wallets-Apple Pay or Google Pay. You can also use your Movo digital credit card to shop online. It works just like a physical card. The app also allows you to quickly create a single-use virtual credit card. You can use a single-use virtual debit card to make a purchase without having to enter your debit card number. After the purchase, your buy move cash account is unusable. There’s no way that your essential card could be compromised.

Movo Cash is safe?

MOVO stated that it recently went through security updates in order to offer a safer and better platform for its users. Although it was somewhat inconvenient for a short time, I believe it is justified.

How Would I Withdraw Money From Movo?

By opening the MOVO app, selecting Digital Banking >> Cash Out to Bank, and then entering the details of the transfer, you can withdraw money from your MOVO(tm) Account to a savings account. You will need to connect a bank account in order to transfer money into or out of your MOVO account.

Getting a Real Card

Movo is all about the digital card but you can also get a physical card. You can’t order a physical Movo card via the Movo cash app. Send an email to support@Movo.cash stating that you would like to receive a card.

Why should you get a physical card instead? A physical card is not only useful, but it’s also more convenient. First, digital cards can’t be used to withdraw cash from ATMs. Cash is still available for some prepaid cardholders. According to our 2018 survey, the average millennial cardholder makes 2-3 ATM trips per month.

Second, digital wallets aren’t always accepted in the same places as physical cards. Apple claims that Apple Pay was accepted in 65% of U.S. retailers earlier this year. Despite this acceptance, Apple anticipates that the number will reach 70% by the end of 2019.

What’s the Bitcoin Stuff?

Then there’s cryptocurrency. Movo is a single prepaid card that allows you to use bitcoin or bitcoin cash to buy or transfer money. It’s an interesting feature, but it raises questions about who would use it. My personal interest in cryptocurrency is low, I will admit. As such, it is possible that I am speaking out of my blockchain by stating that the Bitcoin feature of Movo may be more of a novelty rather than a core function.

It is charged a fee for anyone who intends to use it. Transfers are charged at 2% of the transfer amount and a $2 level fee.

MOVO PREPAID VISA – OTHER FEATURES

Movo Prepaid Visa – Other Features

Movo, like most prepaid cards, offers standard features such as direct deposit and the ability to fund your Movo account via transfers from a bank account. Your Movo card also comes with the following.

Mobile App

This is Movo’s main interest. You can use the app to set up bank transfers, fund your account with Square Cash or PayPal, pay bills and view your exchange history.

BILL PAY

Bill Pay

Movo’s bill payment system allows you to pay any vendor, up to 8,000. You can also set up recurring payments. You will need to find another payment option for vendors who only accept paper checks. Movo does not send paper checks.

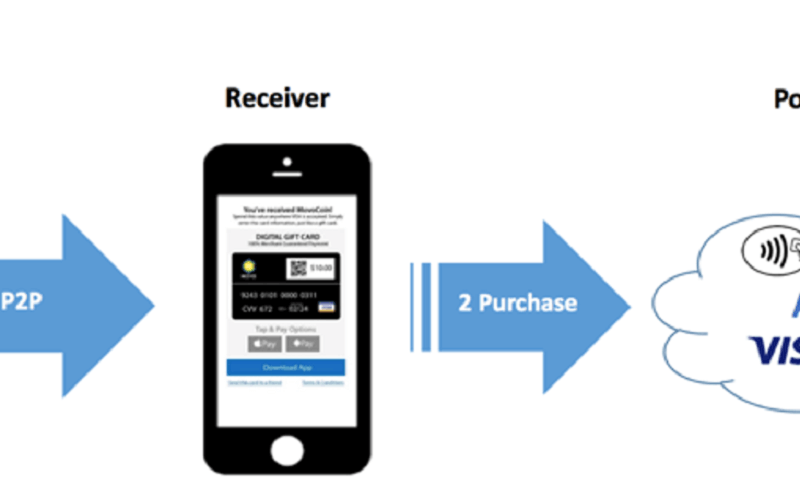

Transfers in Near-Moments to others

Movo has its own P2P payments system. This allows you to send money to anyone using a mobile number or an email address. However, the recipient must have access to their Movo account in order to receive the money. If you send money to someone who doesn’t have a Movo account they will be asked to download the Movo App. Movo will return your money if they do not download the Movo app within three days.

Purchasing Bicone

Yes, bitcoin. To make payments through Movo, you can use your bitcoin or bitcoin cash wallet. The recipient does not need to have bitcoin in order to make transfers. The currency will be converted into dollars. We may all soon be using bitcoin, who knows?

Movo Fees

The Movo fees, as far as I’m concerned, are one of the best features. The app, as well as a physical or digital card, cost nothing. There is no monthly fee, and there are no exchange fees. Movo also offers bill pay and free transfers to other Movo applications. If you decide Movo is not for you, there’s no fee to request a balance refund. It’s pretty nice. Movo does not offer A

TM withdrawals at any cost. Movo charges $2 per withdrawal, notwithstanding any fees charged by the ATM operator/owner. Additionally, bitcoin transfers cost $2 plus 2% for the amount transferred.

You can also load cash to your Movo card through direct deposit or a bank transfer, just like other prepaid cards. Movo also offers cash loads via Visa ReadyLink, Green Dot MoneyPak, and Green Dot. Movo does not charge cash loans on prepaid cards that use these services. However, retailers who offer them will. Cash load fees range from $3.74 to $5.95. Movo does not charge a monthly fee. However, this is only insofar that you are using the card. If the card isn’t used for at least 90 days, an additional fee of $4.95 will be charged.

Movocash Accounts for purchase, Movocash accounts to buy Movo Cash Accounts available, best MovocashAccounts, MovocashAccounts About MOVO, and Movo Cash Accounts For Sale MOVO This is a better way to send/receive money, charge, and make commitments regardless of your credit rating or economic background. FDIC-insured USA bank service provider Green dab is available. You can buy movo cash accounts. This service is available for all countries.

Transform your phone Into a mobile payment and banking device

Forget about the old bank methods. The world is changing and so should banking and financial commitments. MOVO is changing the traditional methods of accessing banking and payment services. It puts the bank in your pocket while giving you control over your finances.

Consumers can access the MOVO Program (TM) regardless of their credit history and credit score. It also includes compelling payment and banking utility essential for current mobile users.

- Send money and get it instantly and for free

- Create a CASH Card (virtual card) to get instant cash access and invest

- You can schedule and pay your charges quickly and without a lot of hassle.

- You can load funds for free by opening a bank account, or directly using P2P services such as Square Cash, PayPal, and Google Wallet.

- Direct deposit is a free service that allows you to get your paycheck quicker. You can also load cash at thousands if retail locations, such as divider shop and seven eleven, Safeway, and Vons.

You can manage your balance, deposit, and trades in a hand-friendly area directly from the PROGRAM.

Our goal is to provide effective ways to access and interact with your money in an ever-mobile environment. If you need Movo cash accounts, then this is the right place. Now is the time to get your MOVO accounts verified. Movocash Accounts are the best available. Don’t delay, buy Movocash accounts today and start enjoying it.

Movo is personally made available to me as a company account

MOVO cash accounts are for personal use only. The account that is used for business purposes has different rules and regulations. Here, you can buy movo money account. MOVO is looking into business accounts to offer a potential product offering. You can open an online movo cash bank account and create a movo money account. It’s very easy to buy verified movecash account. Here you can Movocash Accounts to buy. We offer Buy Movocash Accounts. Don’t waste your time looking for Buy Movocash Accounts. Buy verified Movocash Accounts right now

What is the maximum amount I can spend on the movo cash balance?

- There is a daily maximum amount that you cannot exceed. These cutoff points can be found in the MOVO terms & conditions.

- Loading funds from a bank account

- It’s easy to transfer funds from your bank into your MOVO account(TM).

To load funds from a bank account to Movo

Register through the website of your lender to access your internet account and buy movo money.

You will need to connect MOVO(r), if you don’t have one, to your bank account.

Follow the instructions of your bank to ship capital (Direct deposit or ACH) into a MOVO account.

These ACH bank transfers usually take 1 to 2 business days. The funds will be posted to your MOVO Account(tm) within a few days after the withdrawal from your bank account.

Is my currency FDIC incurred?

Yes. Yes! All funds in your MOVO Account(TM), are held at Metropolitan Commercial Bank. FDIC insurance is available for your MOVO Account(tm).

If you are looking to purchase Movocash accounts, you can contact us immediately to place an order. You can buy Movocash accounts with the exact number you require.

Main Concern

Movo is your prepaid card, if you are crazy about bitcoin, then buy movo cash. Movo’s prepaid cards are a good choice even if you’re not a member of Movo’s network. This card can be used for very little, despite the fact that it requires no ATM withdrawals or savings. This is the best option for Bitcoin enthusiasts or anyone who wants to save money on monthly prepaid card fees.

There are many places to buy Google Play Developer Accounts. But there’s only one place where you can get the Google Play Developer Accounts fully verified and secured. Here you can Movocash Accounts to buy. We offer Buy Movocash Accounts. Don’t waste your time looking for Buy Movocash Accounts. Buy verified Movocash Accounts right now.

Reviews

There are no reviews yet.